If My Client Base is Solid, Why Do I Need Credit Insurance?

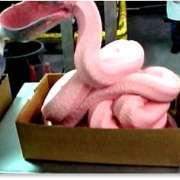

“So, why should I buy accounts receivable insurance?” is probably one of the most common questions I get asked from potential policy holders. It’s really quite simple, you should buy credit insurance because of pink slime…. That’s right, pink slime!

Here is this month’s example, although I have examples for every month of the year. Recently, news agencies started to discuss the existence and use of a food-additive product conservatively labeled as “pink slime.” It is a ground beef filler that includes most of the waste parts of the cow, which then is cleansed with either ammonia or citric acid. It is forbidden to sell directly to the public and it frequently is used for ground beef filler.

One of the unforeseen consequences of the chain reaction of this sudden public outcry was the filing of bankruptcy of one of the largest food processing companies in the industry. King of Prussia, PA-based AFA Foods processed about 500 million pounds of beef annually. Like many companies these days, they may have been perched on the precipice of success, a little push one way or the other and the story written would be different.

How many creditors out there considered the possibility that AFA would be pushed into bankruptcy by a sudden change in public opinion? Can’t read that on a balance sheet! The fact is, there are a number of factors that can’t be read on a balance sheet. For example, aggressive expansion, technological obsolescence, mismanagement, fraud, poor process control, and poor marketing are all easily identified - after companies go bankrupt.

Let me throw out a few other names for you to recall and you tell me if bankruptcy was a foregone conclusion for some of these household names: Lehman Brothers, Fuller Brush Company, Kodak, Polaroid, Leading Edge Computers and Solyndra.

You may not recall Leading Edge Computers; they were very hot when I first started in credit. So hot, in fact, that VARs (Value Added Resellers) had to pre-pay for shipment of the computers. The problem was that they suddenly went bankrupt leaving many VARs as unsecured creditors. Credit was extended, whether or not they knew it, to an insolvent company simply because of the technology and price point.

In the Solyndra case, I can just imagine how many sales people argued that if the government could provide $535 million in loans then surely they must be credit worthy! Additionally, they were named by our country's President as one of the companies to watch for America's future growth in solar panels. Ener1 was similarly identified by the President as a leading-edge company and yet filed bankruptcy two days later.

Nothing can take the place of old-fashioned credit analysis. This is the foundation of good credit practices, but sometimes - and this is the reason for credit insurance - there are unforeseen factors that influence the performance and survival of your customers. Whether those are the court of public opinion, mismanagement, or a bad acquisition, companies go bankrupt, leaving you and your company in jeopardy.