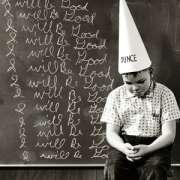

How Can Credit Insurance Help If My Client is an Idiot?

Compliance with the terms, conditions and reporting requirements of an accounts receivable insurance policy is not only critical to having claims paid but also to early intervention in problem accounts that can increase cash flow and reduce losses.

During a regularly scheduled review of past due balances, a policyholder was asked why a specific buyer was past due. Instead of the normal “the check is in the mail” or “the balance is disputed” the insured responded, “My customer is an idiot.” After determining more detail was needed to explain the past due, it turned out the debtor was stalling, using a number reasons, none of which were valid.

After consultation, it was agreed that the policyholder should take a more aggressive collection approach, including advising the buyer that the debt was insured and by which credit insurance company.

While initially unmoved, further explanation of the adverse impact a claim filing would have on their ability to obtain credit from other suppliers with a credit insurance policy, would have solved the impasse.

When the buyer finally realized the negative impact that the failure to pay this single supplier would have on his ability to obtain vitally needed trade credit, he paid the insured in full. The policyholder advised, however, that the debtor was not happy about having to pay.

While much is made of technological solutions to compliance matters, nothing beats personal interaction with someone who understands your business to come up with a specific plan to meet a specific problem. In short, when your customer is an idiot, the person you turn to work through those issues with, better be an expert.